- July 27, 2021

- Posted by: Rivero, Gordimer & Company

- Category: Business Advice

By Christopher F. Terrigino, CPA

Significant changes are soon taking effect regarding the accounting treatment for traditional operating leases (i.e., your retail store leases). Accounting Standards Update (ASU) No. 2016-02, Leases will be effective for all companies with a fiscal year beginning after December 15, 2021 (effectively the 2022 fiscal year), and early implementation is allowed.

What this means for your organization is that if you are preparing financial statements in accordance with Generally Accepted Accounting Principles (GAAP) (this is what your bank wants to see) you may now be required to record a right-to-use asset and a lease liability on your balance sheet for leases that were previously considered operating leases. This is a significant change from the prior accounting treatment that only required footnote disclosures in the financial statements related to these lease obligations.

Fortunately, the new standard does not significantly change existing guidance for lessors (those who own the facility or equipment being leased) and will result in little impact to the accounting treatment for lessor finance leases and operating leases. These changes significantly impact the lessee accounting. This article will only focus on the common aspects of the lessee accounting treatment.

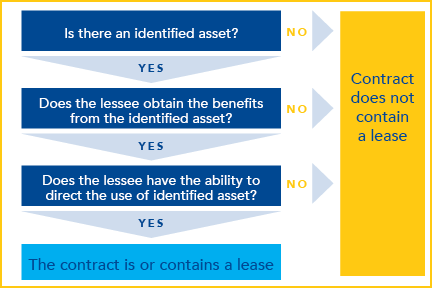

A lease is defined as a contract that conveys a right to control an identified asset for a period of time in exchange for consideration. An analysis must be made at inception of a contract to determine whether the contract is or contains a lease. The organization starts by looking at the contract and answering a few questions as follows:

Determining Lease Classification

When a lease is identified, the next step is to determine whether the lease is a finance lease (formerly referred to as “capital lease”) or an operating lease, since this will determine the accounting treatment.

To determine the lease classification, the following questions need to be addressed:

- Does the lease transfer ownership of the underlying asset to the lessee by the end of the lease term?

- Does the lease grant the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise?

- Is the lease term for a major part of the remaining economic life of the underlying asset (greater than 75% of the remaining useful life at inception)?

- Is the present value of the sum of the lease payments and any residual value guaranteed by the lessee, that is not otherwise included in the lease payments, substantially all of the fair value of the underlying asset (greater than 90% of the fair value at inception)?

- Is the underlying asset of such a specialized nature that it is expected to have no alternative use to the lessor at the end of the lease term?

If the answer to any of the above questions is “yes,” the lease is a financing lease. If the answer to all the above questions is “no,” then the lease is an operating lease.

To help understand the lease classification, consider a truck lease as an example. Many times, this type of asset lease would meet the economic life or ownership transfer criteria and be considered a financing lease. Now consider a retail store lease, which would most likely not meet any of the above criteria and thus would be considered an operating lease.

Exceptions to the Rules

Fortunately, the new lease standard identifies exceptions to the new lease reporting requirements to achieve practical application of the rules and reduce the effect of recordkeeping on the organization. Some of the more common exceptions that an organization will experience are as follows.

- An organization may elect an accounting policy to not apply the new lease standards to short-term leases. A short-term lease is defined as a lease that has a term of 12 months or less at commencement and does not contain an option to purchase at the end that is expected to be exercised. The existence of options to extend the lease term for additional periods past the 12-month period may disqualify the lease from the short-term lease exclusion if it is reasonably certain that the options will be exercised.

- Donated or bargain price leases (such as $1 per month/year lease costs) are excluded from the guidance.

- An organization may elect to utilize its capitalization policy in determining whether a lease is significant or material to the financial statements. This will allow for many organizations to omit consideration of individual low value leases. But, if there are numerous small value leases for similar items, such as computers or cell phones, the lessee may group these items in the application of the guidance.

An additional exception may be considered for related-party leases. The guidance stipulates that “leases between related parties should be classified in accordance with the lease classification criteria applicable to all other leases on the basis of the legally enforceable terms and conditions of the lease. In the separate financial statements of the related parties, the classification and accounting for the leases should be the same as for leases between unrelated parties.” This can be interpreted to allow an organization to omit related-party leases from consideration under the new lease standards. Many times, related-party lease terms and conditions are less formally documented, and the same person may represent the lessor and the lessee.

Recognition

For both financing and operating leases, the lessee will now recognize a “right-of-use” (ROU) asset and a lease liability. The ROU asset and lease liability will be initially recognized at the present value of the lease payments. Lease payments consist of the following:

- Fixed payments, including in-substance fixed payments, less any lease incentives paid or payable to the lessee.

- Variable lease payments that depend on an index or a rate (i.e., Consumer Price Index), measured at the rate of the lease commencement date. Variable payments not tied to such an index are excluded and recognized in the period incurred.

- The exercise price of an option to purchase the underlying asset if the lessee is reasonably certain to exercise the option.

- Payments for penalties for terminating the lease, if the lease term reflects the lessee exercising this option.

- Fees paid by the lessee to the owners of a special purpose entity for structuring the transactions.

- Amounts probable of being owed by the lessee under residual value guarantees.

- Payments associated with renewal or termination options or the exercise of a purchase option if it is reasonably certain that the lessee will exercise the option.

The lease liability will be recognized in an amount equal to the present value of the lease payments at the lease commitment date. To determine the present value, a discount rate must be used. The discount rate for the lease is the rate contained in the lease agreement or the effective incremental borrowing rate for the organization (such as the rate on the organization’s line of credit). A single discount rate may be applied for all leases in the company, so it will often be much more efficient to utilize the organization’s incremental borrowing rate to determine the present value of the lease payments.

The ROU asset value consists of the sum of the following:

- Amount of initial measurement of the lease liability.

- Payments made by a lessee to the lessor at or before the lease commencement date minus any lease incentives received.

- Initial direct costs incurred by the lessee.

The ROU asset and lease liability will often be equal at lease commencement.

Recognizing the expenses and reduction on the ROU assets and lease liability will differ based on whether the lease is a financing or operating lease. For a financing lease, the lessee will amortize the ROU asset on a straight-line basis over the expected useful life (generally monthly) as amortization expense. The lease liability is reduced for the present value of cash payments and interest expense will be recognized for the difference between the cash payment and the liability reduction.

For an operating lease, the organization will recognize a single lease cost combining the discount on the lease liability with the amortization of the ROU asset on a straight-line basis. The lease liability is reduced for the present value of cash payments, with the interest portion of the payment being included in the amortization expense.

Financial Statement Presentation

Presentation on the balance sheet for a financing and operating lease will be similar. Under the new standards, the balance sheet will include a right-of-use asset and a lease liability for both financing and operating leases and will display the totals for each type of lease classification separately from each other and from the other assets or liabilities. Allocation of current and long-term portions will also need to be disclosed for the balance sheet presentation.

Example of balance sheet presentation:

Presentation of financing and operating leases differ on the income statement. For financing leases, the allocated interest expense on the lease liability payments shall be presented in a manner consistent with how other interest expenses are presented. The amortization of the ROU asset shall be presented in a manner consistent with how the entity presents other depreciation or amortization of similar assets.

For operating leases, reduction of the ROU asset and allocated interest on the lease payments will be recorded together as an operating expense on the income statement.

On the statement of cash flows, for financing leases, the lessee will classify cash payments for the principal portion of the lease liability within the financing activities section. The cash payments for the interest portion of the payments will be included in the operating activities section. For operating leases, the lease payments will be included in the operating section of the cash flow statement.

Financial Statement Disclosures

The financial statement note disclosures related to leases have been significantly expanded under the new lease standards in order to allow users to better understand the timing, amount, and cash flow requirements arising from an organization’s lease activity. Disclosures in the notes to the financial statements will now include the following, when applicable:

- Information about the nature of its leases and/or subleases, including:

- A general description of the leases.

- The basis and terms and conditions on which variable lease payments are determined.

- The existence and terms and conditions of options to extend or terminate the lease. A lessee should provide narrative disclosure about the options that are recognized as part of its ROU assets and lease liabilities and those that are not.

- The existence and terms and conditions of residual value guarantees provided by the lessee.

- The restrictions or covenants imposed by leases, for example, those relating to dividends or incurring additional financial obligations.

- Information about leases that have not yet commenced but that create significant rights and obligations for the lessee, including the nature of any involvement with the construction or design of the underlying asset.

- Information about significant assumptions and judgments made to determine whether a contract contains a lease, the allocation of the consideration in a contract between lease and nonlease components, and the determination of any discount rate(s) used.

- Amounts relating to a lessee’s total lease cost, which include both amounts recognized in profit or loss during the period and any amounts capitalized as part of the cost of another asset in accordance with other topics, and the cash flows arising from lease transactions.

- Maturity schedule of its finance lease liabilities and its operating lease liabilities separately, showing the undiscounted cash flows on an annual basis for each of the next five years and a total of the amounts for the remaining years.

- Whether an accounting policy election was adopted for the short-term lease exemption.

- Lease transactions between related parties.

- Quantitative information related to the leasing activity, including:

- Finance lease expense segregated between amortization of ROU assets and interest on lease liabilities.

- Operating lease expense.

- Sublease income.

- Cash paid for amounts included in the measurement of lease liabilities, segregated between operating and financing cash flows and between finance and operating leases.

- Noncash information on lease liabilities arising from obtaining ROU assets, segregated between finance and operating leases.

Transitioning to the New Standard

Two options exist for an organization when adopting and implementing the new lease standards. Option 1 is to apply the new lease standard to all periods presented in the financial statements and reflect a cumulative-effect adjustment to the earliest period presented.

Option 2 is to apply a cumulative-effect adjustment to retained earnings as of the beginning of the period in which the standard is adopted.

When applying the second option, relief is provided for existing leases that will ease the transition assessment.

Lease accounting will require significant judgments and reassessments during the lease term, which will require an organization to make changes in their processes and internal controls. For organizations with numerous leases, IT systems may need to be upgraded or purchased to capture and report the necessary information.

Conclusion

There is much more to the new lease standards than is being presented in this article. For organizations with numerous leases and contracts, it would be prudent to consult the originating guidance and your accounting professional to assist with the transition and implementation of the lease standards. Organizations need to start analyzing their lease portfolios prior to the implementation date to be sure they have all the necessary information ready.

RGCO has experienced professionals who can assist in properly applying these new standards for your business. If you are working through these changes and have questions, please contact us at 813-875-7774.